Purposeful Family Leadership

Legacy and Dynasty Plan of Money & Story for My Grandchildren

Legacy is your story, your values, your experiences and principles that you’ve lived throughout your life. Sharing those with your children and grandchildren and passing them on to succeeding generations is your Legacy.

An example is a teenager who grew up in Los Angeles during the 1950′s & 60′s, receiving deriving instructions from his grandfather on the dirt roads of rural Utah. As the teenager drives along feeling all grown up, his grandfather reaches over and turns off the key, stopping the car and the joy of driving is over.

When Grandpa is asked why he did that, he responds “I asked you to stop and you kept going”. To which the city boy responds “You never said stop”. Of course the adult is always right and grandpa responds “I said Whoa, at least three times”. The city boy, who seldom was around horses, did not know what that meant, so he kept driving.

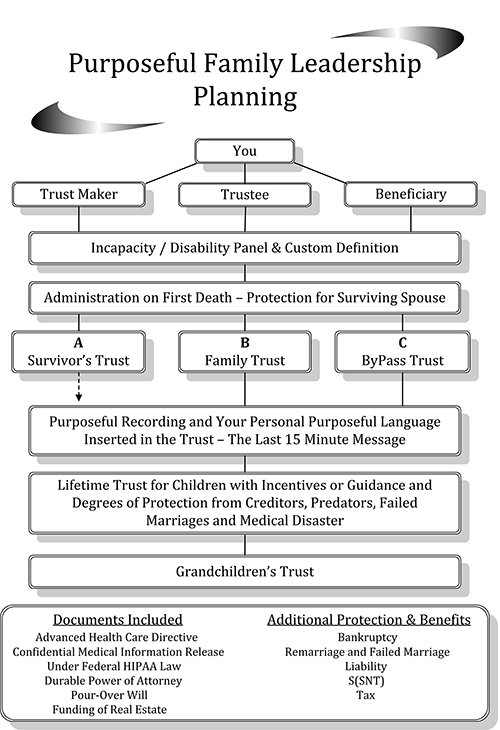

The personal legacy planning includes the purposeful recordings which are interviews that we conduct with you on a number of topics that will preserve the story of your life for succeeding generations.

Dynasty planning controls your assets and passes those assets on to your grandchildren and succeeding generations. Each generation gets to use a portion of the assets and then pass the balance on to the next generation. This is the tool used by some of the wealthiest families to pass their wealth on to succeeding generations.

The Dynasty planning has major tax benefits and implications that will save substantial estate taxes, as well as ensure financial stability and resources for your children, grandchildren and succeeding generations.

They will have use of the funds but not ownership. Having use of the funds allows them to do most anything, while at the same time, protect the funds from loss to creditors, liability, a medical catastrophe or a failed marriage.